What Is Decentralized Finance( DeFi)?

Decentralized finance or DeFi is an emerging monetary technology which is based on safety distributed checks analogous which are being used by cryptocurrencies.

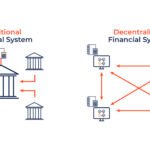

In the U.S., the Federal Reserve and Securities and Exchange Commission( SEC) define the rules for centralized fiscal institutions like banks and brokerages, which consumers calculate to pierce capital and fiscal services directly. DeFi challenges this centralized fiscal system by empowering individualities with peer-to-peer digital exchanges.

DeFi remove the freights that banks and other companies charge for providing with the services that they use. Individualities hold up plutocrats in a very secure digital portmanteau manner, which can use to transfer finances, and DeFi can be used with any internet connection.

What Are the Benefits of Decentralized Finance?

Decentralized finance leverages crucial principles of the Ethereum blockchain to increase fiscal security and translucency, unlock liquidity and growth openings, and support an intertwined and standardized profitable system.

- Programmability. Largely programmable smart contracts automate prosecution and enable the creation of new fiscal instruments and digital means.

- Invariability. Tamper-evidence data collaboration across a blockchain’s decentralized armature increases security and auditability.

- Interoperability. Ethereum’s composable software mound ensures that DeFi protocols and operations are erected to integrate and round one another.

- Translucency. On the public Ethereum blockchain, every sale is broadcast to and vindicated by other druggies on the network.

- Permissionless. Unlike traditional finance, DeFi is defined by its open, permissionless access anyone with a crypto portmanteau and an Internet connection, anyhow of their terrain and frequently without any minimal quantum of finances needed, can access DeFi operations erected on Ethereum.

Read more: DeFi Protocols: What Can We Learn From the Top 10

What Are the Use Cases for Decentralized Finance?

From DAOs to synthetic means, decentralized finance protocols have uncorked a world of new profitable exertion and occasion for druggies across the globe. The comprehensive list of use cases below is evidence that DeFi is much further than an arising ecosystem of systems. Rather, it’s a noncommercial and intertwined trouble to make a resemblant fiscal system on Ethereum that rivals centralized services because it’s profoundly more accessible, flexible, and transparent.

Asset operation

With DeFi protocols, you’re the custodian of your crypto finances. Crypto holdalls like MetaMask, Gnosis Safe, and Argent help you fluently and securely interact with decentralized operations to do everything from buying, dealing, and transferring crypto to earning interest on your digital means.

Compliance and KYT

In traditional finance, compliance around anti-money laundering( AML) and fighting- the backing- of- terrorism( CFT) relies on know-your-client ( KYC) guidelines.

DAOs

A DAO is a decentralized independent association that cooperates according to transparent rules decoded on the Ethereum blockchain, barring the need for a centralized, executive reality. Several popular protocols in the DeFi space, similar to Maker and Emulsion, have launched DAOs to fundraise, manage fiscal operations, and polarize governance to the community.

Data and analytics

Because of their unknown translucency around sale data and network exertion, DeFi protocols offer unique advantages for data discovery, analysis, and decision-making around fiscal openings and threat operations.

Derivations

Ethereum-grounded smart contracts enable the creation of tokenized derivations whose value is deduced from the performance of a beginning asset and in which counterparty agreements are hardwired in law. DeFi derivations can represent real-world means similar to edict currencies, bonds, and goods, as well as cryptocurrencies.

Inventor and structure driving

DeFi protocols is composability, meaning various features of a system can easily connect and interoperate. From various DeFi operations we can conclude that composable law has produce an main or chief network effect where the community carry on to make upon what others have build. Numerous liken the process of DeFi development to structure with legos — hence the decreasingly popular surname “ plutocrat legos. ”

DEXs

Decentralized exchanges( DEXs) are cryptocurrency exchanges that operate without a central authority, allowing druggies to distribute peer-to-peer and maintain control of their finances. DEXs reduce the threat of price manipulation, as well as hacking and theft because crypto means are noway in the guardianship of the exchange itself.

Gaming

The composability of DeFi has uncorked openings for product inventors to make DeFi protocols directly into platforms across a variety of verticals.

Identity

Decentralized finance protocols paired with blockchain-grounded identity systems are an occasion to help preliminarily locked-out druggies pierce a truly global profitable system. DeFi results can reduce the collateralization conditions for people who don’t have redundant finances and help assess druggies ’ creditworthiness via attributes around character and fiscal exertion, rather of traditional data points similar to home power and income.

Insurance

DeFi is still an arising space with attendant pitfalls around smart contract bugs and breaches. Several innovative insurance druthers have come to request to help druggies buy content and cover their effects. results like Nexus Mutual, for illustration, give a Smart Contract Cover that protects against unintended uses of smart contract law.

Commerce

DeFi protocols are supporting an array of online commerce that allow druggies to change products and services encyclopedically and blink- to peer — everything from freelance coding gigs to digital collectibles to real-world jewelry and vesture.

Read more: Impact Investing and the UN Sustainable Development Goals (SDGs)

Savings

By plugging into advancing pool protocols like emulsion, numerous DeFi apps offer interest-bearing accounts that can earn exponentially further than traditional savings accounts, depending on a dynamic interest rate tied to supply and demand.

Image Source: nvatechs