Fraud is an ever-present threat in the world of finance. From credit card fraud to insider trading, unscrupulous individuals are constantly seeking ways to exploit vulnerabilities. To counteract these threats, financial institutions are turning to big data analytics for fraud detection and prevention. In this article, we will explore the critical role of big data analytics in safeguarding the financial industry.

The Growing Challenge of Financial Fraud

Financial fraud is a persistent challenge, costing businesses and individuals billions of dollars annually. Fraudsters employ various techniques, including identity theft, cyberattacks, and insider trading, to exploit weaknesses in the system. The consequences of financial fraud extend beyond monetary losses; they erode trust and tarnish reputations.

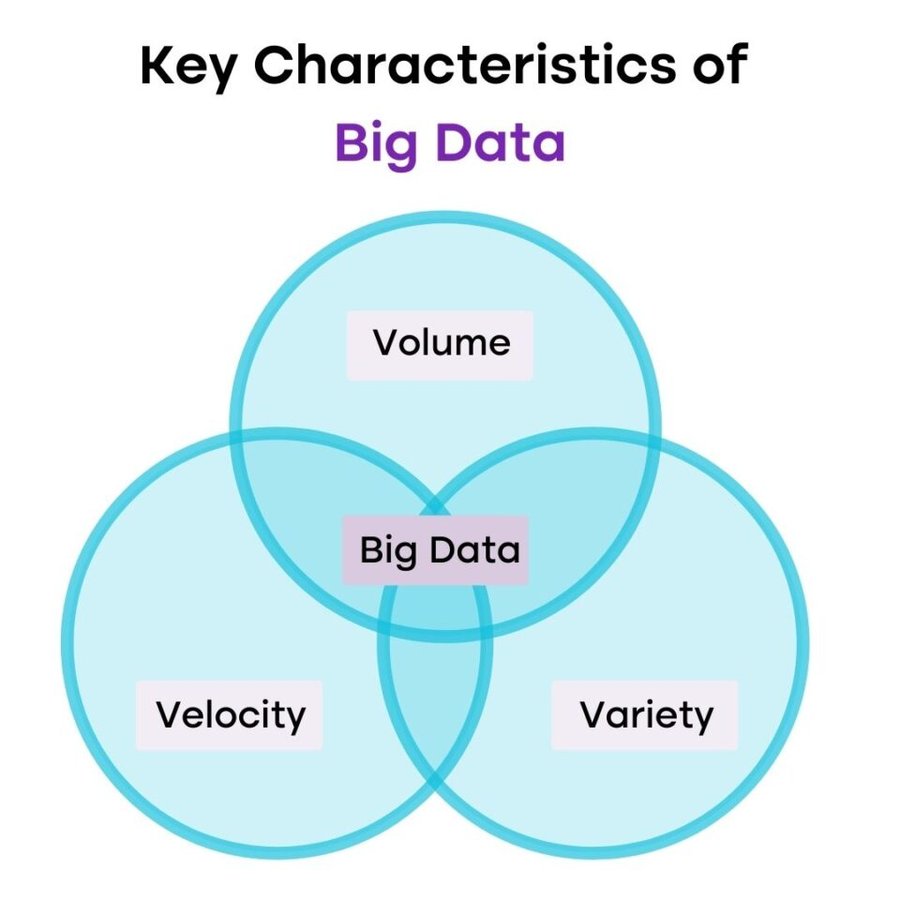

The rapid advancement of technology has created new avenues for fraud, making traditional methods of detection and prevention inadequate. This is where big data analytics steps in, offering a dynamic and comprehensive approach to combat fraud effectively.

Big Data Analytics: A Game-Changer in Fraud Prevention

Big data analytics leverages cutting-edge technology to process and analyze vast amounts of data from various sources in real time. It provides a multifaceted solution to fraud detection and prevention:

1. Pattern Recognition: Big data analytics can identify patterns and anomalies in data, such as irregular transaction activity or unusual user behavior, which are indicative of potential fraud.

2. Machine Learning and AI: Machine learning algorithms can be trained to recognize fraud indicators by analyzing historical data, adapting to new tactics used by fraudsters.

3. Real-Time Monitoring: Big data analytics enable real-time monitoring of financial transactions, allowing institutions to detect and halt fraudulent activity as it happens.

4. Customer Profiling: Advanced analytics can build detailed profiles of customers, identifying their typical behaviors and flagging unusual activities for further investigation.

5. Data Fusion: Big data analytics can combine various data sources, such as transaction history, customer information, geolocation data, and social media sentiment, to provide a more holistic view of a customer’s activity and detect inconsistencies.

Fraud Detection in Practice

Implementing big data analytics for fraud detection involves a series of steps:

1. Data Collection: Gather data from various sources, such as transaction logs, customer profiles, and external data feeds.

2. Data Preprocessing: Clean and prepare the data, eliminating errors, duplicates, and irrelevant information.

3. Pattern Recognition: Use machine learning algorithms to detect patterns and anomalies in the data.

4. Alert Generation: When a potential fraud indicator is detected, an alert is generated for further investigation.

5. Investigation and Resolution: Human experts or automated processes analyze the alerts to determine whether fraud has occurred and take appropriate action.

Read more: Algorithmic Trading and High-Frequency Trading (HFT): Unleashing the Power of Automation

Prevention Through Data-Driven Insights

While fraud detection is crucial, preventing fraud from happening in the first place is even more effective. Big data analytics can also play a pivotal role in fraud prevention:

1. Risk Assessment: By analyzing historical data, big data analytics can help institutions assess the risk associated with different types of transactions and activities.

2. User Authentication: Multi-factor authentication, biometrics, and behavioral analytics are increasingly used to enhance user verification and protect against identity theft.

3. Machine Learning-Based Rules: Institutions can create complex rules for fraud prevention based on machine learning algorithms that adapt to evolving fraud patterns.

4. Customer Education: By analyzing user behavior and transaction history, financial institutions can offer education and guidance to customers, helping them recognize and prevent fraud.

Challenges and Considerations

While big data analytics is a powerful tool for fraud detection and prevention, there are challenges to overcome:

- Data Privacy and Security: As more data is collected, institutions must ensure it is protected and used responsibly, complying with data protection regulations.

- False Positives: Overly sensitive fraud detection systems can generate false positives, potentially inconveniencing customers. Striking the right balance is crucial.

- Scalability: As the volume of data grows, systems must scale to handle the increasing workload without sacrificing performance.

- Human Expertise: Skilled professionals are needed to interpret the results of big data analytics and make informed decisions.

The Future of Fraud Detection and Prevention

As technology continues to advance, so will the sophistication of fraudsters. To stay ahead, financial institutions will rely more heavily on big data analytics, AI, and machine learning. The future of fraud detection and prevention in finance holds the promise of real-time detection, more accurate predictive analytics, and an even higher level of security for customers.

The landscape of financial fraud is constantly evolving, with fraudsters adopting increasingly sophisticated techniques. To counter this, the future of fraud detection and prevention will rely on cutting-edge technologies and strategies:

Real-Time Fraud Detection: As fraud attempts occur in real time, financial institutions will need to implement real-time fraud detection systems that can analyze transactions instantaneously. Machine learning models will be critical in flagging suspicious activities in real time, allowing for immediate intervention.

Biometric Authentication: Biometrics, such as facial recognition, fingerprint scanning, and voice recognition, will become more prevalent in user authentication. These methods offer a higher level of security by making it extremely difficult for fraudsters to impersonate customers.

Behavioral Analysis: Advanced behavioral analytics will be employed to assess user behavior and establish patterns. By analyzing factors like typing speed, the angle at which a mobile device is held, and even the language used in text messages, institutions can detect unusual behavior.

Advanced AI and Machine Learning: AI and machine learning will become increasingly sophisticated, learning from historical data and adapting to new fraud tactics. They will continually evolve to recognize and prevent fraud attempts effectively.

Blockchain Technology: Blockchain’s transparency and immutability make it a robust tool for fraud prevention. By creating a secure, tamper-proof ledger, blockchain can verify transactions and prevent fraud in a variety of financial processes, such as supply chain management and identity verification.

Collaborative Data Sharing: Financial institutions and law enforcement agencies will collaborate more closely to share data and intelligence about emerging fraud patterns. This collective approach will help prevent fraud on a larger scale.

AI-Powered Chatbots: AI chatbots will play a dual role in customer service and fraud prevention. They will assist customers while simultaneously monitoring and detecting unusual behavior in real-time conversations.

Regulatory Framework and Compliance

As the financial industry adopts more advanced fraud prevention technologies, regulatory bodies and compliance standards will need to evolve in tandem. It’s essential to balance innovation with the need to protect customers and their data. Key considerations include:

- Data Privacy: Stricter data protection regulations will require financial institutions to adhere to the highest standards of data privacy. They must protect customer information and gain explicit consent for data usage.

- Transparency: Financial institutions will need to be transparent with customers about how their data is used for fraud detection and prevention. Clear communication will be vital to build trust.

- Compliance with Emerging Technologies: Regulations must keep pace with emerging technologies, ensuring that financial institutions are using the latest tools for fraud prevention while remaining compliant.

- Data Sharing: Regulations governing data sharing and collaboration between institutions and law enforcement agencies must be clear and well-defined to facilitate effective fraud prevention.

- Accountability: Financial institutions must be held accountable for their fraud detection and prevention practices. Regulations should enforce strict penalties for institutions that fail to protect their customers adequately.

Read more: Risk Management and Big Data Analytics: Mitigating Uncertainty with Data-Driven Insights

Conclusion

The battle against financial fraud is an ongoing challenge. With the rise of big data analytics, AI, machine learning, and other innovative technologies, financial institutions have formidable tools at their disposal to detect and prevent fraud. The future holds the promise of even more efficient and effective fraud prevention, ensuring the safety and security of both financial institutions and their customers.

However, it’s important to remember that the fight against fraud is a collective effort. Regulatory bodies, law enforcement agencies, financial institutions, and customers must work together to create a secure financial ecosystem where fraud is a rarity rather than the norm. In this future landscape, customers can have confidence that their financial assets and personal information are protected from the ever-evolving tactics of fraudsters.

In conclusion, big data analytics is a game-changer in the fight against financial fraud. It provides the financial industry with the tools and insights necessary to detect and prevent fraudulent activities. As technology continues to evolve, the battle against fraud will only become more efficient and effective, ensuring the security and trust of financial institutions and their customers.

Image Source: Formica AI