What Is Decentralized Finance( DeFi)?

Decentralized finance or DeFi is an emerging monetary technology which is based on safety distributed checks analogous which are being used by cryptocurrencies.

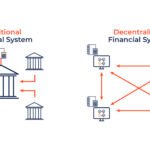

In the U.S., the Federal Reserve and Securities and Exchange Commission( SEC) define the rules for centralized fiscal institutions like banks and brokerages, which consumers calculate to pierce capital and fiscal services directly. DeFi challenges this centralized fiscal system by empowering individualities with peer-to-peer digital exchanges.

DeFi remove the freights that banks and other companies charge for providing with the services that they use. Individualities hold up plutocrats in a very secure digital portmanteau manner, which can use to transfer finances, and DeFi can be used with any internet connection.

Centralized Finance vs. Decentralized Finance( DeFi)

Centralized Finance

In centralized finance, the plutocrat is held by banks and third parties who grease the plutocrat movement between parties, with each charging freights for using their services. A credit card charge starts from the trafficker and moves to an acquiring bank, which on the card details to the credit card network.

The network clears the fee and asks the bank for payment. Each reality in the chain receives payment for its services, generally because merchants have to pay for using credit and disadvantage cards.

All fiscal trades are supervised in centralized financing, from credit operations to services of the originating bank.

Decentralized finance

Decentralized finance or DeFi banish depositors by authorizing people, dealer and employment to manage monetary negotiation via leading automation Through peer-to-peer fiscal networks, DeFi utilizes security protocols, connectivity, and software to address advancements.

Wherever there is an Internet connection, individuals can advance, trade, and acquire software that records and verifies fiscal behavior in distributed fiscal databases. The distributed database is accessible across diverse locations because it collects and aggregates data from all drug addictions and uses the medium of contracts to validate them.

How does DeFi work?

Decentralized finance uses blockchain technology, which is used by cryptocurrencies. Blockchain is defined as a distributed and stable database or data. Operations called dApps are used to process transactions and run the blockchain.

In blockchain, transactions are recorded in blocks and also confirmed by other users. However, the block is closed and folded; another block is created that contains information about the previous block if those validators agree to sell.

Blocks are “chained” together through the information in each ongoing block, giving it the name blockchain. Information in previous blocks cannot be changed without affecting subsequent blocks, so there is no way to change the blockchain. Secure nature of the blockchain is being provided by this concept, along with other security protocols.

Using DeFi

Peer-to-peer (P2P) fiscal transactions are one of the main domains behind DeFi. A P2P DeFi is defined as the sale where two parties permit to interchange cryptocurrency for goods or services excluding the participation of a third party.

P2P payments are made through a decentralized operation or dApp and follow the same process in the blockchain.

Using DeFi allows for

• Availability Anyone with an internet connection can pierce a DeFi platform and deals without any geographic restriction.

• Top- interest rates DeFi allow two parties to arrange interest rates and excellent plutocrats through DeFi networks.

• Security and translucency Smart contracts published on a blockchain and records of completed deals are available for anyone to review but don’t reveal your identity. Blockchains are inflexible, meaning they can not be changed.

The Future of DeFi

Decentralized finance is constantly evolving.

Each with its own set of laws and rules, current laws were drafted grounded on the idea of separate fiscal authorities, . Essential questions for this type of regulation are presents by DeFi’s borderless sale capability.

What Does Decentralized Finance Do?

The thing of DeFi is to challenge the use of centralized fiscal institutions and third parties that are involved in all fiscal deals.

Is Bitcoin a Decentralized Finance?

Bitcoin is a cryptocurrency. DeFi is being designed to use cryptocurrency in its ecosystem, so Bitcoin is not DeFi as important as it’s a part of it.

What is the total value locked in DeFi?

Total value locked (TVL) is the sum of all cryptocurrencies staked, lent, pooled or used for other fiscal behavior across the entire DeFi. It can also represent the sum of specific cryptocurrencies used for fiscal adjustment, similar to ether or bitcoin.

Conclusion

Decentralized finance (DeFi) is an emerging fiscal technology that challenges the current centralized banking system. Banks and other financial companies charge fees which is removed by DeFi for using resources and promotes the use of peer-to-peer, or P2P, transactions.

Image Source: Navi